Summary

In today’s digital age, scamming has become an issue for both individuals and businesses online. Online scams can come in many forms, but with the proper education, it is easy to spot scams that are trying to trick you.

In today’s digital age, scamming has become an issue for both individuals and businesses online. Online scams can come in many forms, but with the proper education, it is easy to spot scams that are trying to trick you. In this article, we will explore what online scams are, how to recognize common signs, and steps to take to protect yourself and your business.

How do online scams work?

There are many types of Internet scams that employ their own techniques on various platforms. Here are a few common types:

- Phishing scams are the most popular and usually come as messages or emails that look to be from a reputable and legitimate source. For example, you may receive an email from your bank to reset your password. Most of the time, the messages you receive are too good to be true—chosen for a contest you never entered, or reset a password for an account you have had for years. In reality, the scammer is trying to steal your personal information to use to their own benefit or receive a payment from you.

- Ransomware Attacks are a technique used by scammers to forcefully receive payment in exchange for access back to your device and data. This access can come in various types of files downloaded from email, the internet, or any file-sharing site.

- Advance Fee Scams require you to pay an upfront fee with the promise of a larger financial return. Always, the scammer will not follow through and the return never materializes. This ploy is to simply receive money for a fake promise.

What should I watch out for? (what to watch out for)

It is vital to be critical of messages and what you are downloading on the internet. To protect yourself and your data, here are some red flags to watch out for:

- The message incurs urgency and requests something to be done quickly – Take a step back and try to see if this action is too good to be true. Deadlines instill fear in a reader, and the scammer is trying to get you to impulsively click.

- Misspellings or bad grammar – An easy way to spot scams is simple misspellings or grammar mistakes. Be critical of the punctuation, quality of writing, and formatting.

- Check the links and sender – Links embedded within the message might not be to what they truly are typed out to show. To discover where they might lead, simply hover over and verify the address it is leading to. Make sure that the email address is also correct from any previous messages you have had from the person/business and it does not have any random numbers or letters hidden. In any case, DO NOT click the link within an email that you are suspicious of. Doing so might lead for your computer to be remotely accessed and personal information to be stolen.

- Request for personal information – After looking over any visual differences in the message, it important to understand what they are asking for. If the scam message is requesting personal information, do not provide anything that is apart of your identity. Any information given to them is one step towards helping them crack into your accounts.

How do I protect myself?

There are plenty of precautions you can take to protect yourself and avoid falling for scams online.

- Create strong passwords – Avoid using personal identifying information, use different passwords across accounts, and make them long with special characters and numbers. You should also opt to use Two Factor Authentication for an extra layer of protection, making it harder for scammers to get into your account.

- Never share personal information – Such as your telephone number, address, bank account number, and Social Security number.

- Trust your gut – Be skeptical, and if something seems suspicious or not authentic, then it likely is.

- Keep an eye on your accounts online – Checking your accounts every so often will allow you to review your purchases and see any activity that might not have been from you. If you find any unauthorized transactions in your statements, report any discrepancies as soon as possible.

If you think you have been scammed, it is important to act quickly. To report the incident and understand what steps to take if you fall victim to a scam, learn more at this link from the Federal Trade Commission here: https://reportfraud.ftc.gov/#/

How do I protect my business?

Are you a business owner? It is important to protect your assets with Cyber Liability Insurance. This coverage provides protection and peace of mind for your data and personal information.

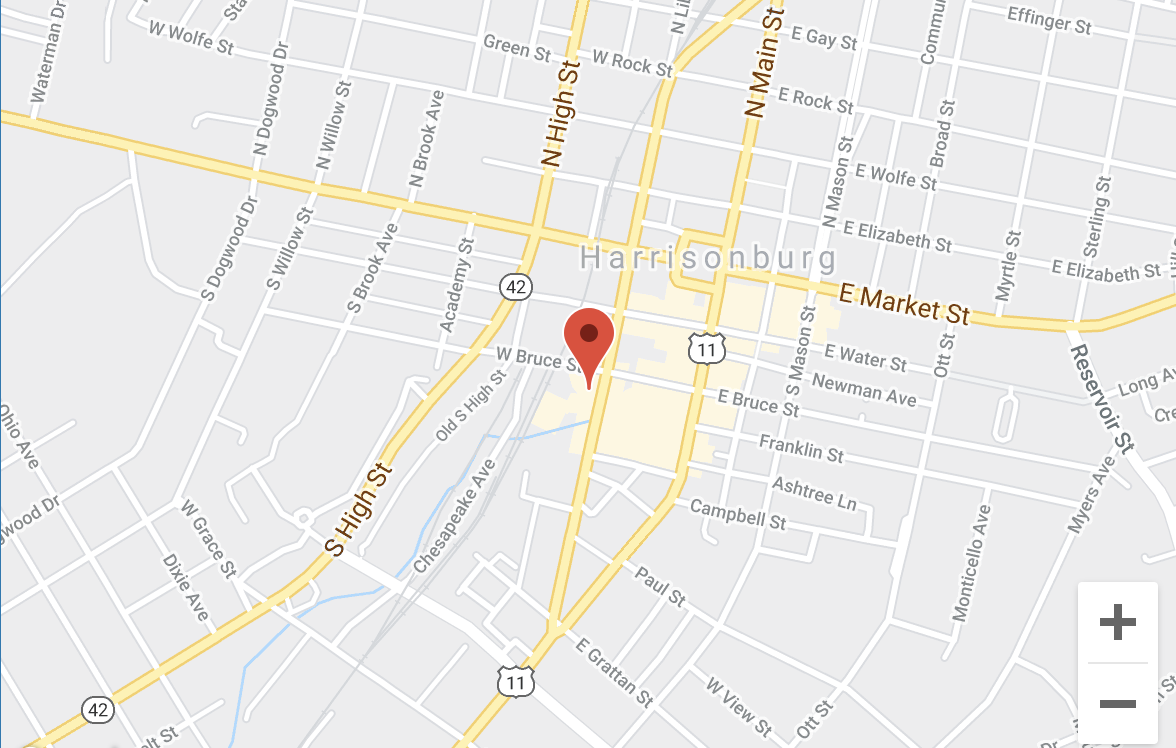

Here are LD&B, we offer quality cyber liability insurance for businesses in the Shenandoah Valley. Call or submit a quote request today to connect with a business insurance agent and learn more!