auto & vehicle

We’ll help you get moving in the right direction.

Wherever you’re headed, we’ll partner with you to protect your investment — and your precious cargo. As an

independent agent, we work with multiple carriers to find the policy that best suits your needs. We also offer

periodic insurance reviews to help ensure that as your life changes, your insurance keeps pace.

auto insurance

Auto insurance coverage has two parts. The first part is the liability section of the policy, which covers your financial responsibility for injuring others. Most states require some liability coverage. The second part of auto insurance covers the car itself: comprehensive coverage reimburses losses from fire, theft, or other perils; collision coverage pays to repair losses caused by an accident. Often this coverage is mandated by leasing companies or banks. You can help reduce your premiums by utilizing high deductibles on physical damage coverages.

There are also ancillary medical, car rental, and other coverages which vary by state, as well as umbrella insurance which can avoid a gap in coverage for a serious accident.

collector car insurance

Protect your investment! There is a big difference between collector car insurance policies and regular use policies, because traditional auto insurance carriers are geared towards insuring a larger volume of vehicles. They simply don’t know how to treat your specialty or collector car. Classic or collector car insurance can save you a significant amount of money and increase your coverage.

Classic cars are usually considered antique vehicles (15 to 20 years old or older).

Collector cars can also include:

- Exotic autos, new and old

- Muscle cars

- Sports cars of all ages

- Rare or desirable cars

atv insurance

All-Terrain Vehicles (ATVs) are becoming increasingly popular and now come in a variety of models. Insurance companies have different sets of rules for providing coverage for ATVs depending on the vehicle type.

ATV insurance is very similar to motorcycle insurance. All-terrain vehicles are three-, four-or six-wheeled buggies used off-road. 4 x 4 insurance has the same basic coverage included in the motorcycle insurance policy, tweaked for the needs of off-road enthusiasts. We can help you get the specialized coverage you need to protect your investment and let you focus on having fun.

motorcycle insurance

Whether you’re an enthusiast or a first-timer, it’s essential to find the right insurance for your motorcycle. In many states, you must carry basic insurance to cover the cost of losses you cost to others in an accident. Motorcycle insurance also protects you against loss in case of an accident.

Motorcycle insurance is a way of sharing the risks of riding between you and your insurance company. You pay a set premium to an insurance company for coverage. In return, the company promises to pay for specific financial losses that might occur during the time of the policy. If the unexpected happens, insurance gives you peace of mind knowing you are protected. At LD&B, we have a variety of motorcycle policy options to meet your needs.

boat and marine insurance

Boat and Marine insurance is available for small boats, yachts, high-performance powerboats, live-aboard houseboats, catamarans, or pontoons. Marine insurance will cover intended use including personal recreation, commercial, or charter vessels.

Both policies can cover damage to your boat, motor, trailer, and the personal effects you keep in the boat. Available coverage includes liability, medical payments, injury to a water skier, and damage to the boat itself, sometimes called hull coverage. Availability varies by state and by insurance company. Even though boat insurance premiums are low, shopping your rate can sometimes save a substantial amount.

personal watercraft insurance

snowmobile insurance

Because people use their snowmobiles in so many different ways, it can be challenging to find good, low-cost insurance. From touring sleds to back-country machines, every snowmobile and its rider has a different insurance need. At LD&B, we can provide affordable snowmobile insurance coverage that helps protect you, your passenger, and your snowmobile.

motorhome / rv insurance

Let's talk

How do you choose the right coverage?

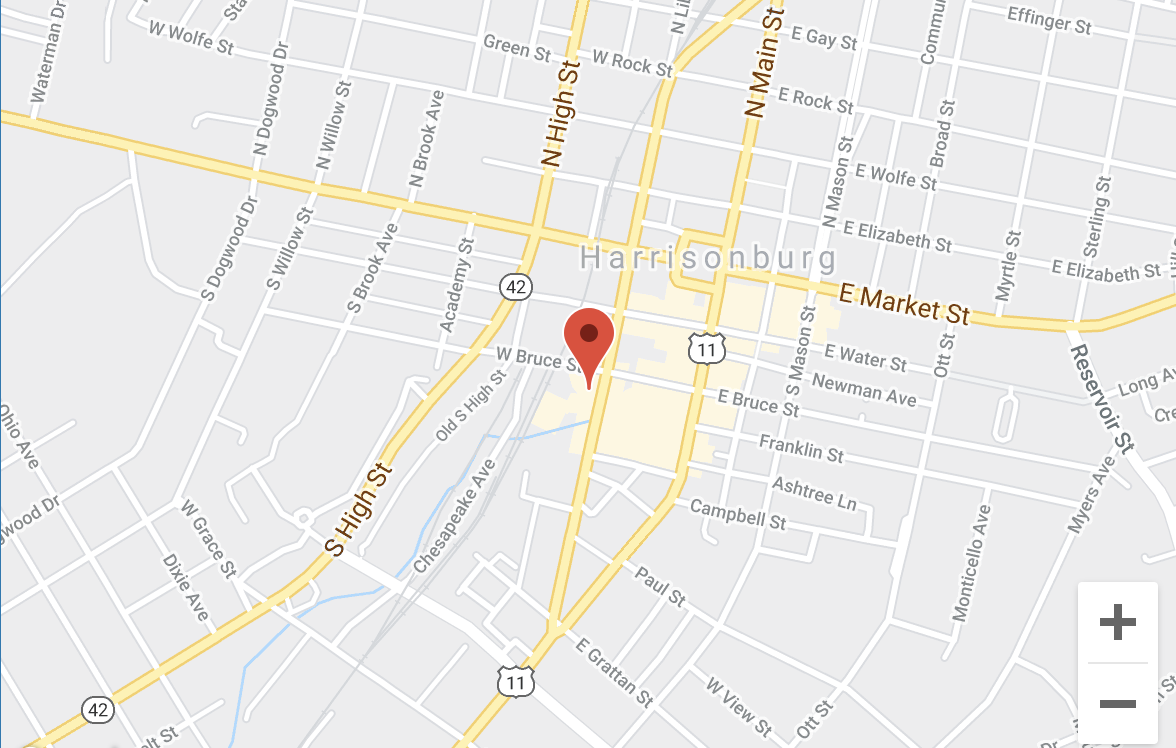

We’ll walk you through your options to make sure you have the right policy for your auto or vehicle. Contact one of our team members today for a comprehensive review of your needs.

protect your investment