umbrella

Protect yourself from negligence claims

Personal umbrella insurance can help provide inexpensive “peace of mind” for most types of negligence claims.

Automobile accidents are probably the most common source of serious claims,

however these policies also cover other types of catastrophic claims.

Personal umbrella insurance is more affordable than you'd think.

A personal umbrella policy helps protect you from liability or lawsuits that are not covered under your auto or home insurance. Personal umbrella policies have high limits — starting at $1 million — so they can kick in when you’ve exceeded the limits on your home or auto insurance. An umbrella policy also covers certain claims or legal fees, which are not covered by other types of personal insurance. However, an umbrella policy does not cover legal fees in the case of criminal cases, nor does it cover damage to your own property or person.

If you have assets that exceed the limits on your home or auto policies, anticipate becoming a high earner, or have a lifestyle or job that could lead to being sued, umbrella insurance might be beneficial to you. Despite offering millions of dollars worth of coverage, it can be more affordable than you’d think

When Should I Consider an Umbrella Policy?

- If your assets exceed the limits of your existing policies

- If your home has potentially risky amenities, such as a

swimming pool or trampoline - If you have a teenage driver

- If you own a dog

- If you own guns

- ….And more!

Ask Us!

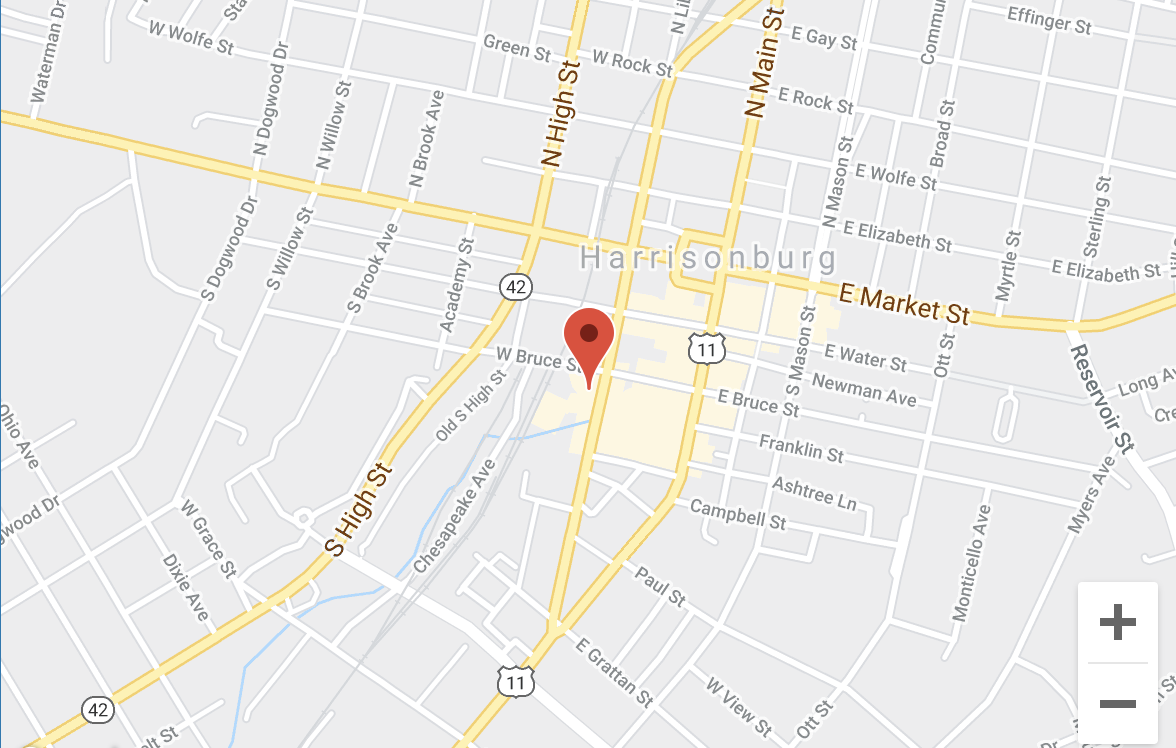

We love questions! Contact us today and our team will thoroughly review your needs and circumstances to make sure you have the right coverages in place.