additional coverages

Additional coverage policies help give you peace of mind.

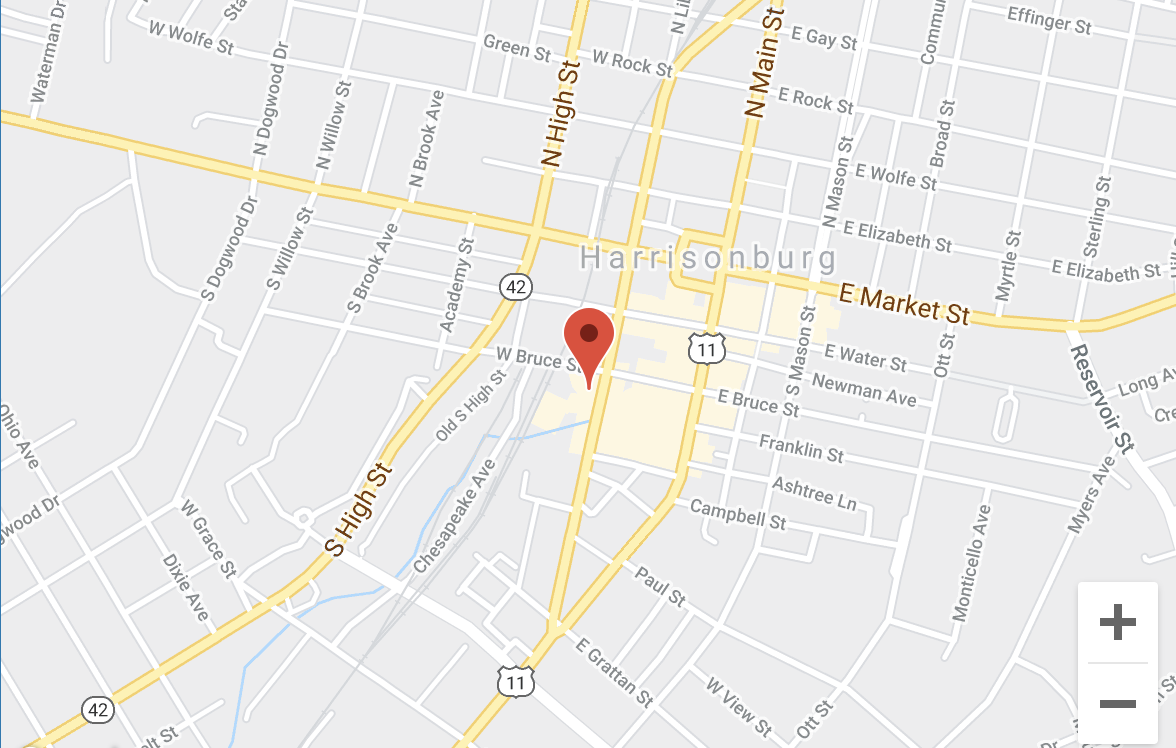

Depending on where you live, additional coverages such as commercial property or flood insurance may be

required. You may also benefit from valuable items insurance or high net worth coverage to help protect all

you’ve worked hard to attain. Just give our team a call, and we’ll carefully review your needs

to help determine what policies are right for you.

Commercial property insurance is a special type of insurance that coverage the company building as well as the company owned contents. Property can also include: lost income, business interruption, buildings, computers, money and valuable papers.

Insurance that protects a business in case a product produced cause harm to a user or user’s property. This type of insurance is recommended for businesses that manufacture a product, and especially important for companies that produce food, clothing, toys, etc.

Property insurance that covers a dwelling or building for losses sustained due to flooding. If the dwelling or building is deemed to have a high flood risk, you will likely be required to buy flood insurance by your bank/mortgage lender.

A policy designed to provide coverage for buildings under construction. The policy can be written to cover the whole structure or for remodeling and renovations. It covers the contractor’s interest in materials at the job site before installed, materials in transit for the job and the value of the property under construction until completion and accepted by the owner.

Insurance that helps protect your investment for a specific event. Examples: E Weddings, Prom, Sporting Events, Concerts, Parades, Company Meetings and Corporate Events.

What should I do if my house floods?

• Call your insurance agent as soon as possible.

• Inventory and photograph all damaged property.

• Make temporary repairs and keep all receipts.

• Get any necessary construction permits.

• Meet with your adjuster before signing anything.

• Delay permanent repairs until your insurer approves

reimbursement.

We're here for you!

Just give our team a call, we will carefully review your needs to help determine what policies are right for you.